If you are a loyalty program manager, VP, CMO, CFO, or even a CEO you may have faced obstacles associated with program expenses. Implementation and ongoing monthly fees can hinder profitability, making it nearly impossible to attain a break-even state on your program investments for the first 14-16 months.

We’ve all at one time said or heard a colleague say the dreaded, “We’ve always done it this way.”

It’s one of the worst statements in business. It’s a mentality that stifles growth and innovation in the office and in the marketplace. A similar stagnation is evident in the traditional approach to loyalty programs, especially as it relates to program costs.

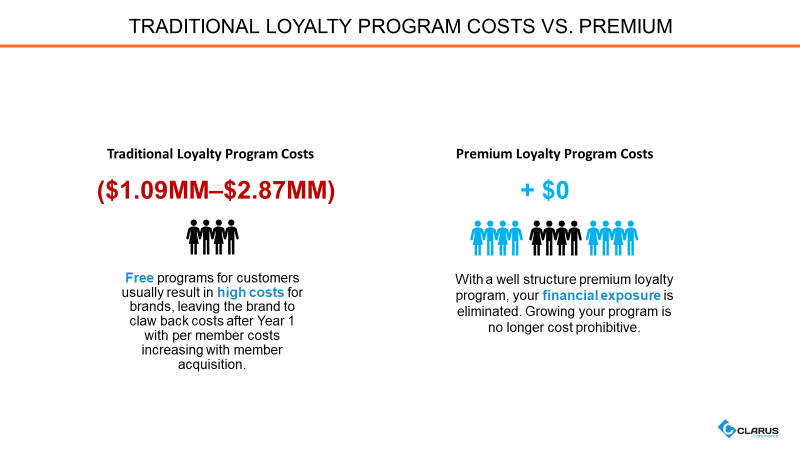

Brands invest hundreds of thousands of dollars, or even millions, to launch new loyalty programs. That exorbitant investment is typically an upfront cost, with the hope that the program reaches a break-even point in 14-24 months.

That seems like an awfully long time for a program to break-even without any guarantee that it ever will.

It’s time to rethink our approach to loyalty program financials.

Loyalty Program Launches Shouldn’t be a Gamble

Traditional loyalty programs typically require massive upfront investments for both vendor costs and internal costs in addition to what can be an excruciating stakeholder approval process, yet they still don’t guarantee a positive ROI. It’s really a gamble and even if they do provide a return, it’s usually not seen for at least a year and a half.

The reason for this is in part due to the fact that most loyalty agencies make a generous amount of money on implementation. A troubled set-up or unsuccessful program isn’t soul-crushing for the agency, like it is for the brand. If they get paid upfront to setup the program, they win, even if their client doesn’t.

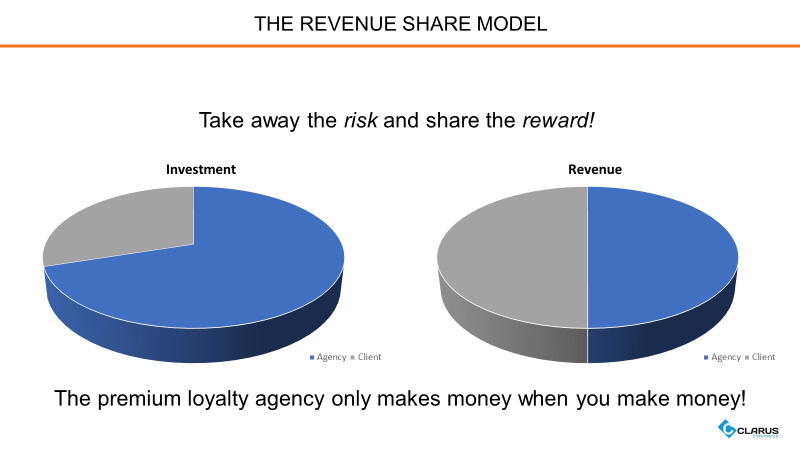

But what if a loyalty service provider put skin in the game for its “state-of-the-art” proven solution?

An agency that takes on the vast majority, if not all, of the financial risks will be fully committed to mutual success. Because it must live with the recommendations it makes, it only wins if the brand’s loyalty program is effective for both parties.

This approach lessens the financial risks for brands and allows them to more easily gain internal consensus toward the implementation of a new or improved customer loyalty and engagement strategy.

It’s typical of a premium loyalty solutions provider.

Premium Loyalty Programs

Premium loyalty programs take the traditional model and turn it around.

Learn more about premium loyalty programs.

A premium loyalty solution requires program members to cover some of the costs through the membership fee they pay to be a part of it. Generally, people support and participate in things they have a financial stake in, which includes loyalty programs.

A growing number of consumers (37%, up from 30% in 2017), are willing to pay a fee for access to enhanced loyalty program benefits.

Willingness to pay for enhanced benefits is significantly higher among Gen Z (47%) and Millennials (46%), as well as households with children (44%) and early technology adopters (69%)

Whereas traditional loyalty programs are limited because the brand must pay for the benefits – often at a 1% funding rate, members, the agency and sometimes the brands share the investment in premium loyalty programs. Most paid programs offer incredibly rich benefits ranging from 10%-20%.

Enter the Revenue Sharing Model

A revenue sharing model between a brand and service provider provides a fairer, mutually beneficial relationship. This arrangement also delivers a new, profitable revenue source.

Brands tend to take few financial risks.

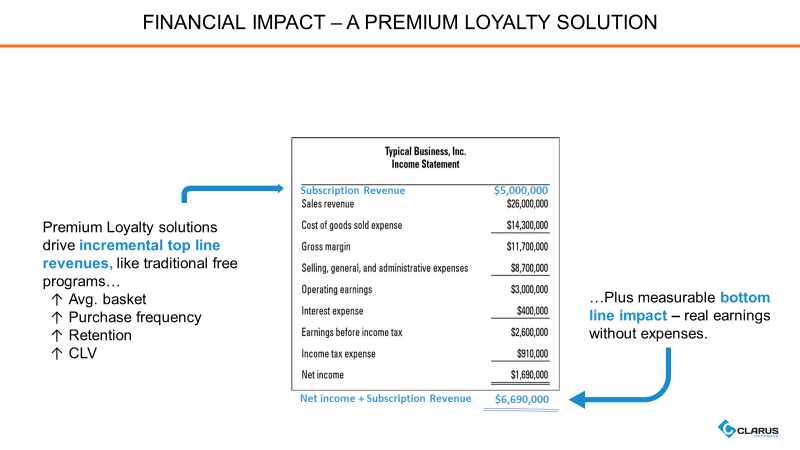

Brands still achieve incremental top-line growth through increased purchase frequency, improved customer retention, and higher customer lifetime value. They also gain the added benefit of significant bottom-line earnings because the revenue share income has no costs against it.

For example, the premium loyalty solutions that Clarus implements in partnership with our clients helps those brands increase these important metrics while avoiding big financial risks.

A Premium Tier Can Complement a Free Loyalty Program

Free loyalty programs have their place. Consumers certainly like points and discounts and most are willing to accept lesser benefits for a free program. It’s an understandable and prudent choice. However, premium loyalty programs exist to provide that needed differentiation for brands who are looking to make their best customers even better.

See how a premium loyalty tier can nicely complement a traditional free program.

A free program allows a brand to maintain a connection with a larger number of its customers who don’t want to pay a fee for better, more exclusive rewards and benefits. The premium program and benefits can be implemented as an elite tier to appeal to the most valuable and elite customers by providing more status, a better earning potential, and superior rewards.

A premium loyalty tier allows a brand to offer benefits that extend beyond typical transactional incentives. These benefits can take many forms, including convenience perks such as: VIP access, free shipping and returns, product samples, white-glove treatment, personal shoppers and much more.

Casual customers that are only interested in signing up for a free program might not care about elevated benefits, but your best customers will. And once customers are in the free program, it becomes easier to convert them into premium loyalty program members.

In addition to increased key metrics like spend, frequency and engagement, the additional income benefits from the premium program also benefits the brand by offsetting the ongoing costs of the traditional free program.

Some examples of successful premium programs in market include GameStop with its Free, Pro, and Elite Pro Membership levels that allow their customers to participate and earn benefits according to their unique desires; and AMC Stubs with its Insider (free), Premiere ($15/year), and A-List ($19.95/month) options. This allows the consumer to choose the level of benefits and the type of movie-going experience they desire.

Consider Your Best Customers

For brands with an existing free loyalty program, it might be time for a meaningful evolution for the sake of your company and your best customers. This is especially true for brands that have programs with 40% or greater inactive members.

In the Age of the Customer where choice abounds, and the consumer is firmly in control, brands need to rethink their loyalty programs because the “same old way” doesn’t allow for evolution. Now is the time for brands to consider how traditional loyalty programs impact their respective balance sheets.

If you’re thinking about launching a new program, consider an exclusive premium loyalty program or, at least an elite tier on top of a free program. This approach gives consumers options, while not restricting enrollments in the program. Consumers have expressed their desires and willingness to pay for an improved experience that includes better and more desirable benefits.

Perhaps it’s time we marketers listen and appropriately respond.